US-China recoupling in an age of decoupling

Love will find a way? Powerful forces keep pulling the US and China together even as geopolitics tries to pull them apart.

“Love will find a way”

The US and China are like two forbidden lovers, desperate to be together, but increasingly pulled apart by geopolitical forces. For decades, growing trade, investment, and people flows between the two countries were driven by natural complementarities between their two economies. American companies like Apple and Nike leveraged China’s nimble, low-cost manufacturing base to become global giants. Chinese students flocked to American universities. Silicon Valley VCs bet big on China’s booming tech scene. Chinese firms like Alibaba and Baidu rushed to list on the New York Stock Exchange and NASDAQ.

But now, political leaders in both countries are trying to cut back ties through tariffs, sanctions, export controls, and a drive for self-reliance. The US has cut off access to advanced AI chips while China has throttled rare earth exports. Chinese policymakers are pressuring state firms to swap out any American tech through the “Delete A” campaign while the US prepares to ban DJI drones. The US has effectively shut out Chinese EVs through 100% tariffs while the list of US websites blocked in China from Google to ChatGPT continues to grow.

Yet, despite the best efforts of their political leaders, people and companies in the US and China are still trying to reach each other: by smuggling Nvidia chips, by rerouting trade through third countries, through VPNs and regulatory loopholes and requests for tariff exemptions.

Now, even as the US and China push to decouple, new ties are being formed between these two competing superpowers. From AI and biotech to robots and robotaxis, the US and China are finding new ways to reconnect. As Lionel Richie once crooned, “Love will find a way.” Or will it? What are the forces driving this recoupling? Where is this recoupling happening? And what are the consequences? Let’s take these questions in turn.

Why is US-China recoupling happening?

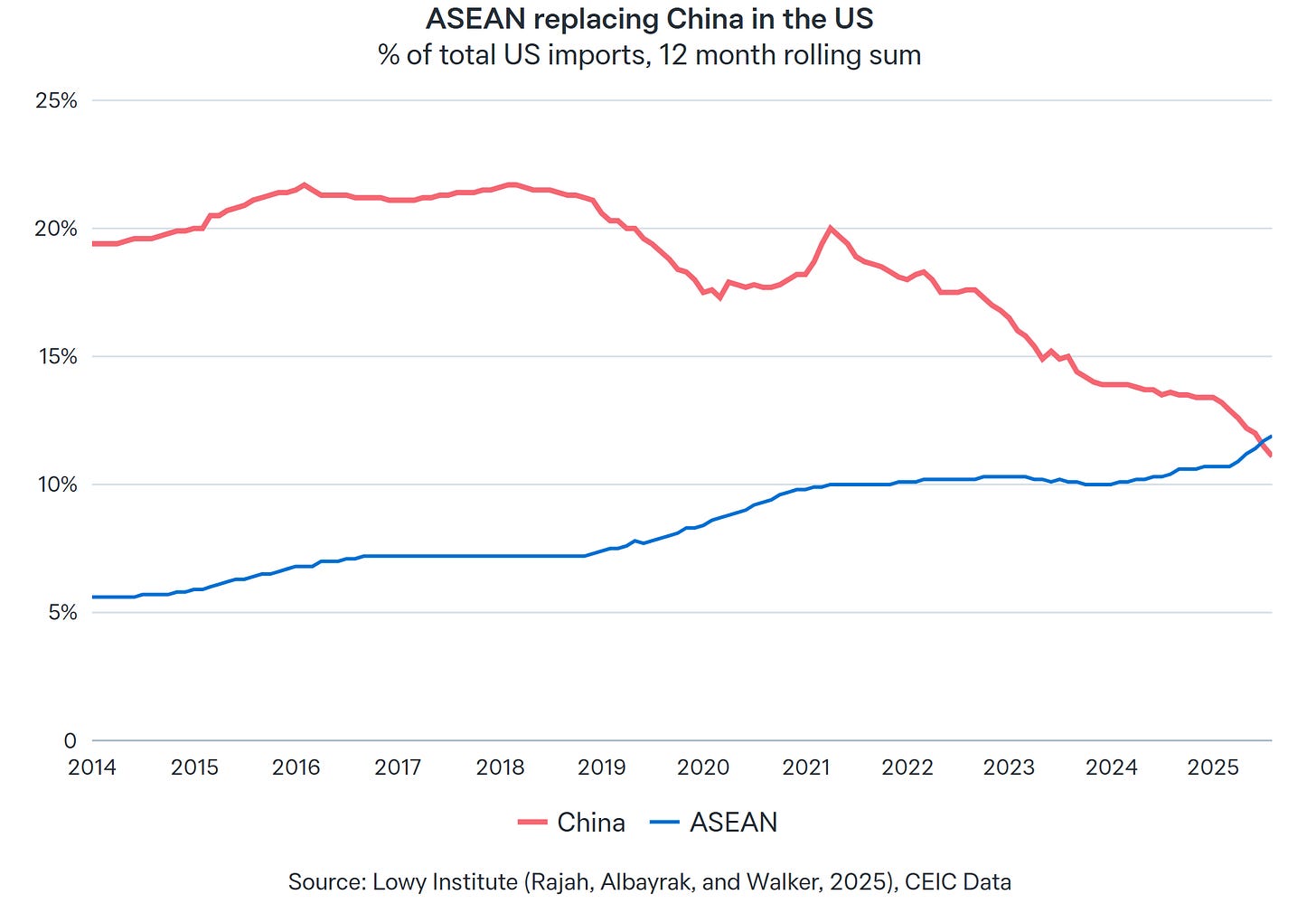

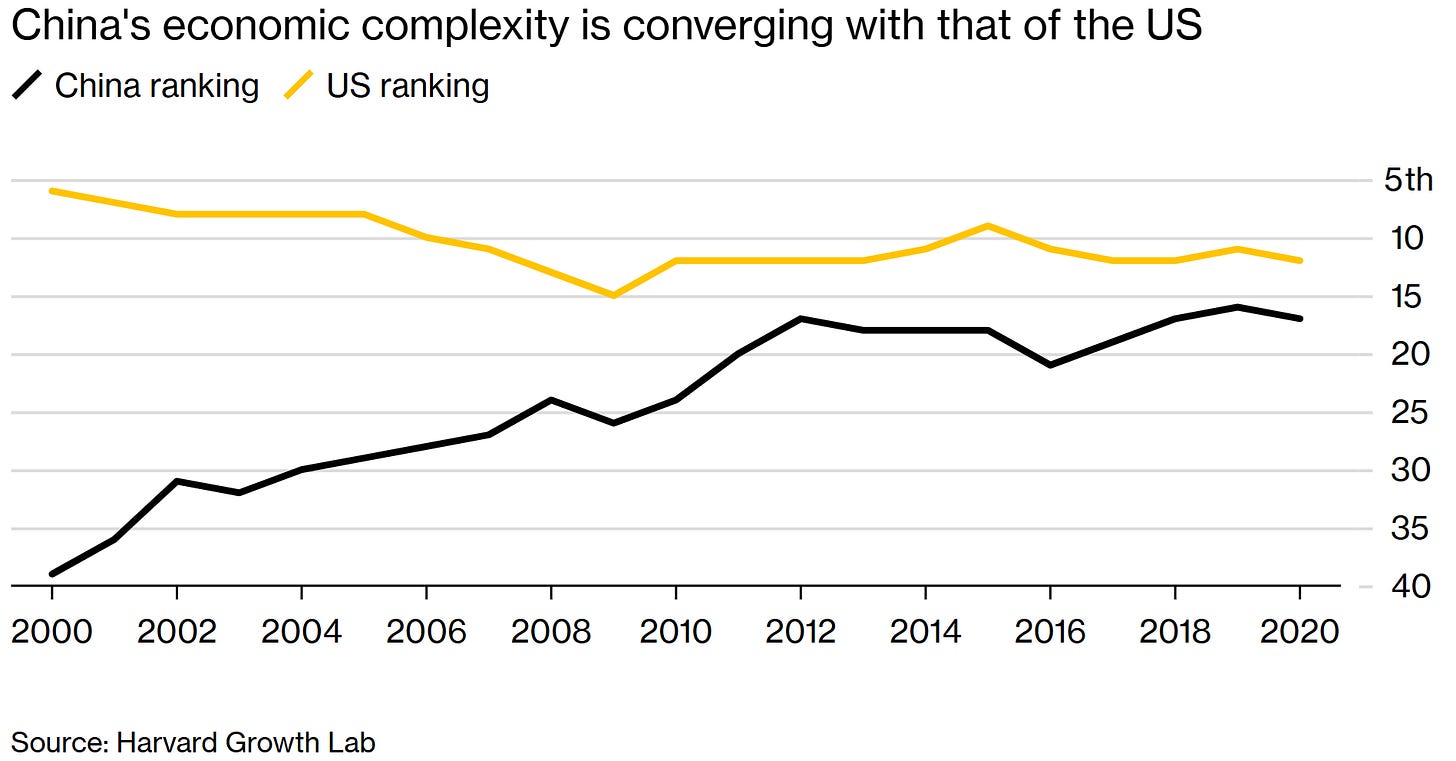

Big, high-tech economies: At one level, it’s driven by structural factors that are not particular to the US-China relationship per se. The US and China are two very large, technologically sophisticated countries operating in the world together. As China moves up the technology value chain in more sectors, its tech relationship with the US looks less like one of a low-cost outsourced manufacturing hub and more like the relationship between the US and the EU, Japan, or South Korea.

In economics, there’s a classic model of trade known as the “gravity model.” Just as gravitational forces are stronger between larger planets that are closer together, the gravity model of trade says that the volume of trade between any two countries is largely a function of the sizes of their economies and their geographical distance. Containerized shipping has shrunk the effective distance between the US and China. And now China’s growing technological strengths and “economic complexity” mean there are even more pull factors not just for trade but for R&D and human capital flows.

Complementary capabilities: At another level, the forces pulling the US and China together are about the particular relationship between their economies and the way their capabilities complement one another. Chinese developers love using American platforms and services like GitHub and Cursor. Chinese AI companies love using Nvidia GPUs. American robotics labs love sourcing components from China and even building on Chinese hardware platforms, like Unitree’s popular G1 humanoid robot.

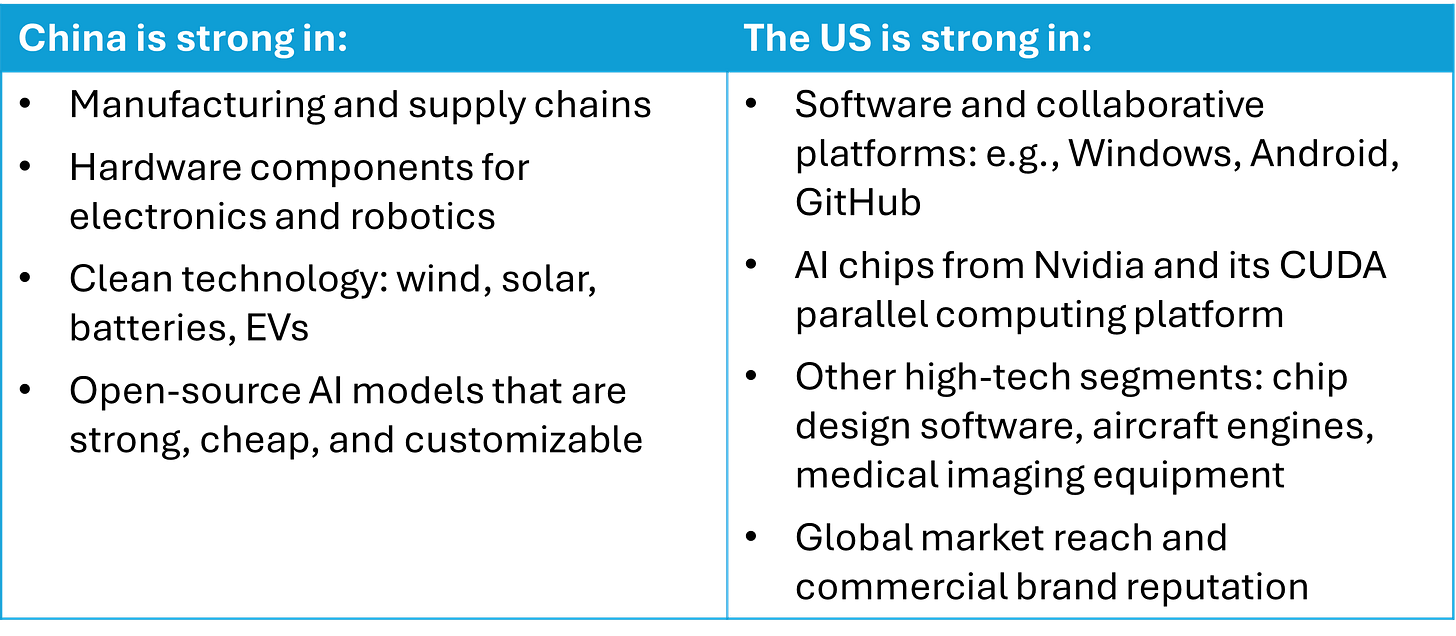

Here are more examples of how the US and China complement each other:

Markets and consumers don’t really care about geopolitics. They simply want the best product or the best performance at the lowest cost. During the Cold War, Afghanistan’s leader Mohammad Daoud Khan famously said: “I feel happiest when I light my American cigarette with Soviet matches.”1 As much as political leaders in Beijing or Washington might want everyone to pick a side, the reality is that many people prefer to mix and match. This is true not only for the US and China but also for countries around the world that are already running Chinese open-source AI models on Nvidia GPUs or buying Teslas made in Shanghai.

Where is US-China recoupling happening?

US-China recoupling is happening across a wide range of sectors, particularly biotech, AI, robotics, autonomous vehicles, and automotive. Here’s a list of some interesting connections:

US robotics firms and Chinese suppliers: Many American robotics companies rely heavily on components from China, such as actuators and reducers. Tesla’s Optimus humanoid robot reportedly uses linear actuators from Sanhua (三花智能), harmonic reducers from Green Harmonic (绿的谐波), and servo motors from Inovance (汇川技术).

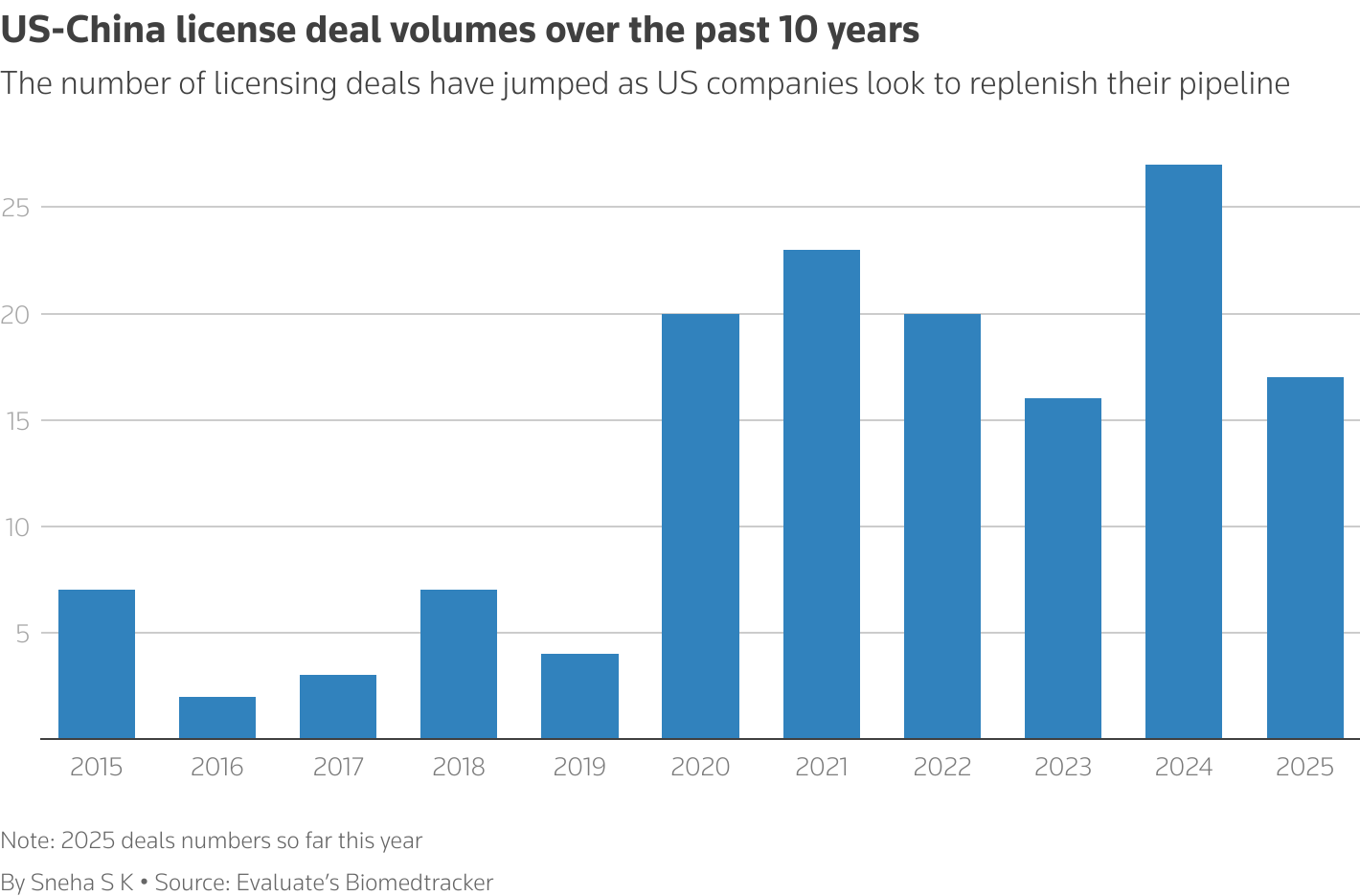

US pharmaceutical licensing deals with China: US pharmaceutical firms like Pfizer and AbbVie are signing more and more drug licensing deals with Chinese companies, particularly in oncology. This trend is likely to grow as Chinese pharmaceutical firms continue to improve in R&D.

US automakers and Chinese battery makers: Ford has licensed LFP battery technology from CATL to manufacture batteries in the US. These batteries will be used for Ford’s new low-cost EVs and for battery energy storage systems for utilities and data centers. Tesla has long used batteries from both CATL and BYD and has been making plans to bring CATL battery-making equipment into the US.

Uber and Chinese robotaxis: Uber has partnered with Chinese robotaxi startups WeRide, Pony.ai, and Baidu’s Apollo Go to serve as a platform for robotaxi services globally.

Waymo and Zeekr: Google’s self-driving car unit has partnered with Chinese automaker Geely to use its Zeekr EVs to build robotaxis. This is happening even in the face of 100% tariffs on Chinese EVs. This suggests that Waymo may want to partner with cost-competitive Chinese EV makers for markets beyond the US.

US cloud service providers and Chinese AI models: US cloud service providers like Amazon Web Services and Microsoft Azure host Chinese foundation models like DeepSeek, Kimi K2, and Alibaba’s Qwen.

AR/VR: For augmented reality and virtual reality devices, American companies are partnering with Chinese manufacturers. Apple’s Vision Pro is made by Luxshare. Meta’s popular Ray-Ban smart glasses and Quest Pro VR headset rely on Goertek.

Chinese robots & EVs and Nvidia chips: Many Chinese robot makers and EV makers such as Unitree, UBTech, Xpeng, Geely, BYD, Xiaomi, and Li Auto use Nvidia chips.

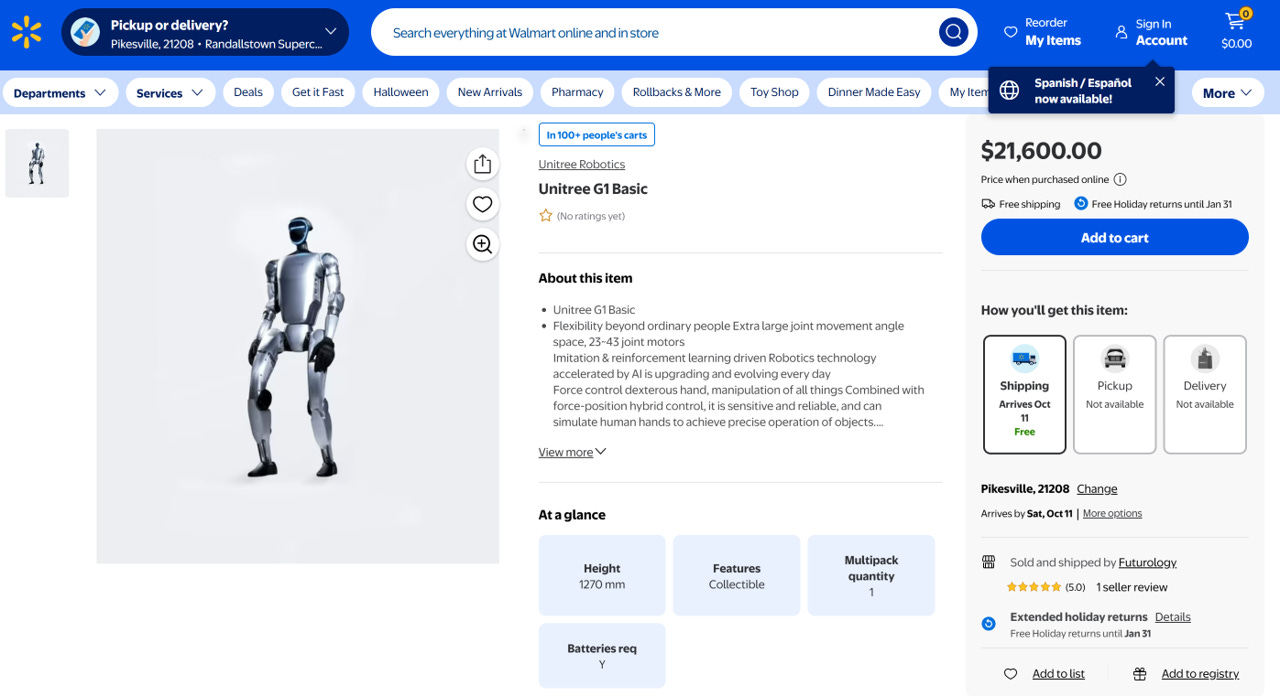

Unitree robots and US researchers: Unitree’s G1 humanoid robot has become a widely used hardware platform for many US robotics labs looking to do research on humanoids (a few examples here). It’s affordable (less than $20,000), highly capable, and available for order online. Amazon has even been testing Unitree’s humanoid robot for delivery services.

US investors and Chinese tech firms: American funds that feature US-listed Chinese tech firms have experienced a large inflow of capital, and dollar-denominated VC funding has grown in China. This is happening even as the US debates whether to delist Chinese tech stocks and impose new bans on US investments in China.

Chinese AI researchers and American AI labs: A large number of AI researchers at American tech firms are from China, including some of the world’s most highly paid talent at Meta’s Superintelligence Labs.

What are the implications of US-China recoupling?

As you scanned through the list of examples of US-China recoupling, one word probably sprang to mind: “chokepoints.” Some of these cases of recoupling will likely receive greater scrutiny by policymakers going forward. Ford’s partnership with CATL has already been criticized by Republican lawmakers. The US House Select Committee on China has expressed concerns over Unitree robots. China is going all-out to replace Nvidia GPUs with domestic AI chips. Given the growing use of geoeconomic tools like export controls and the weaponization of supply chains, it makes sense that new dependencies mean new risks.

But I will argue that the forces of US-China recoupling are not going away. If anything, they will grow stronger as both countries ramp up their efforts to make progress in overlapping tech segments. And increasingly, progress in one country will be dependent on progress in the other.

Previously, I asked whether the iPhone and the entire smartphone revolution would have been possible without Apple’s partnership with China. Looking ahead, we probably can’t even imagine what other products or breakthroughs we’re missing out on through these mutual restrictions. Global progress—on AI or robotics or medical treatments—will increasingly depend on the extent to which the two countries allow themselves to work together. ■

Thank you to Hameeda Uloomi at Yale for sharing this quote with me.

The gravity model framing is useful here becuase it strips away the moralizing and shows why recoupling is structural, not accidental. Economic mass and technological sophistication create pull that policy can slow but probably can't reverse. I worked on supply chain visibility tools for a manufacturing client, and what became clear was that even companies actively trying to diversify out of China kept bumping into the reality that certain capabilities just don't exist elsewher at the same cost and quality combination. The Unitree example is telling - when a $20k robot becomes a de facto research standard, that's not ideology, it's infrastructure.

Hmm while I see the interdependence, it still feels like China is ultimately not that dependent on the US. Many of the key components are still only made in China while China has many alternatives to the American Companies listed here.

For example,

Humanoid robots like Tesla Optimus have many Chinese competitors like Unitree. But components wise, the US has no alternative to Green Harmonics or Sanhua

The best EVs and Batteries are clearly in China and Ford is a one way dependence.

Even self driving, Waymo has plenty of competition from the self driving companies you’ve listed here.

Uber is dominant for now, but Didi exists and is clearly a viable alternative, what happens if these Chinese self driving companies start requiring you to use Didi?

Semiconductors are the only place the US currently holds an advantage but the Chinese are much closer to developing equivalent capabilities than we are to matching their ability to produce hardware.

Even for biotech, the Chinese companies are the ones innovating while the American Companies are merely licensing. Ultimately what does the US offer other than a rich consumer market? And how long will that really last?